What Is Indexation?

Indexation is an efficient way of preventing draining of your returns on investments in the form of taxes. Indexation is applicable to long-term investments, which include debt fund and other asset classes. Indexation helps you in adjusting the purchase price of the investments. In this way, you will be able to lower your tax liability. Before thinking about indexation, you must understand two other concepts – inflation and capital gains.

Inflation is the gradual rise in the price of a product or service. For example, what is worth Rs.100 today may be worth Rs.110 or more in the following year; and even more than that the year after. In this way, inflation reduces your purchasing power.

Key Takeaways

The government has moved an amendment to the Finance Bill, 2024, to let taxpayers select either a 12.5% long-term capital gains tax rate without indexation or a 20% rate with indexation for property acquired before July 23.

Read more at: https://www.ndtvprofit.com/economy-finance/centre-makes-revisions-in-ltcg-indexation-proposal-on-real-estate

Copyright © NDTV Profit

Indexation and Debt Mutual Funds

Let’s say you invested in a debt fund in July 2016. Your investment amount was Rs.10,000, and you bought the units at a NAV of Rs.10. Three years later, you redeem your investments in August 2019 at a NAV of Rs.20. Hence, when you sold your investments, the value of your investments was Rs.20,000. Your investment made capital gains worth Rs.10,000.

However, you need not pay tax on this entire amount of Rs.10,000. As your holding period was three years, you will get the benefit of indexation to reduce the value of your long-term capital gains. To arrive at the Indexed Cost of Acquisition (ICoA), you have to use the following formula:

ICoA = Original cost of acquisition * (CII of the year of sale/CII of year of purchase)

In the example mentioned above, the indexed cost of acquisition will be Rs.10,947, i.e., (10,000 * 289/264).

Hence, instead of Rs.10,000, your capital gains will now be Rs.9,053, i.e. (Rs.20,000 – Rs.10,947).

Using indexation, you would have managed not to pay tax on Rs.947 of your gains. Your tax will be computed on only Rs.9,053, which will be equal to Rs.1,810. The benefit of indexation works best when your holding period is longer. For a holding period of 5 years, long-term capital gains tax on debt funds can come down from 20% to 6-7%. This is how indexation helps you to save tax on long-term capital gains from debt mutual funds and enhance your earnings.

What are the benefits of Indexation?

Indexation is used to adjust the purchase price of an investment to reflect the effect of inflation on it. A higher purchase price means lesser profits, which effectively means a lower tax.

With the help of indexation, you will be able to lower your long-term capital gains, which brings down your taxable income. Indexation is the reason why debt funds are considered an excellent fixed-income investment option when compared to conventional fixed deposits (FDs). Indexation makes the game of investment a win-win affair.

The indexation benefits allowed the seller of real estate to adjust for the impact of inflation when calculating capital gains. The inflation impact was calculated based on the Cost Inflation Index published by the Central Board of Direct Taxes on an ongoing basis.

How Indexation Works: A Quick Example

Let’s say you purchased a property in 2010 for ₹20 lakh. You sell this property in 2023 for ₹60 lakh. Without indexation, your capital gain would be ₹40 lakh, and this entire amount would be taxable.

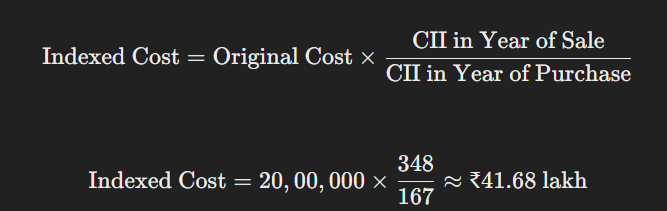

However, if you apply indexation, you first adjust the purchase price using the CII values of 2010 and 2023. Assuming the CII for 2010 is 167 and for 2023 is 348, the indexed cost of the property would be:

Now, your taxable capital gain would be:

₹60 lakh−₹41.68 lakh=₹8.32 lakh

This lower capital gain means you pay less tax, making indexation a valuable tool for investors.

Benefits of Indexation

- Tax Savings: The most obvious benefit is the reduction in taxable capital gains, leading to substantial tax savings, especially on long-term investments.

- Encourages Long-Term Investment: Since indexation benefits are available for long-term holdings, it encourages investors to stay invested for longer periods, promoting financial stability and growth.

- Inflation Adjustment: Indexation accounts for inflation, ensuring that investors are not taxed on nominal gains that merely keep pace with inflation.

Important Considerations

While indexation offers significant tax benefits, it’s essential to remember that it applies only to certain types of assets, like real estate, gold, debt mutual funds, and bonds. Equity mutual funds, for example, have a different tax regime where indexation does not apply.

Moreover, the indexation benefit is only available for long-term capital gains. If you sell your asset within three years, you won’t be able to use indexation, and your gains will be taxed at a higher short-term capital gains tax rate.