Your child’s dreams are precious, and their future deserves the best. With the SmartKid Assure plan , you can ensure their dreams are secured while you enjoy valuable tax * benefits with market linked returns and life cover.

What Is ICICI Pru SmartKid Assure?

The SmartKid Assure plan is a Unit Linked Insurance Plan (ULIP) that combines investment growth with life insurance coverage. It offers market-linked returns through a selection of 24 funds, including index funds, and provides in-built benefits such as:ICICI Prudential Life InsuranceICICI Prudential Life Insurance

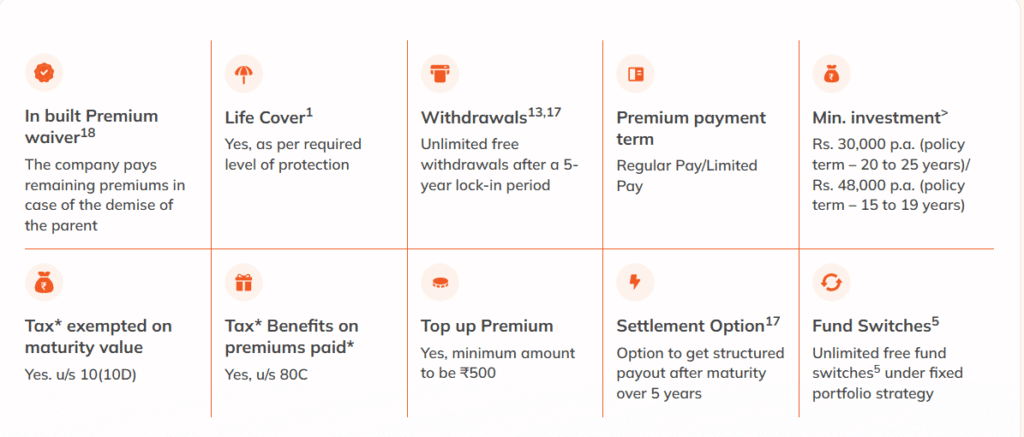

- Life Cover: A sum assured of 10 times the annual premium to secure the parent’s life.

- Waiver of Premium: In case of the parent’s demise, the company waives future premiums, ensuring the policy continues.

- Family Income Benefit: The company pays regular yearly income until the end of the policy term if the parent passes away.

- Maturity Protect: Guarantees 100% return of the invested amount if the fund value falls below the total invested amount.

- Loyalty Additions: Extra units added to the fund value starting from the sixth policy year, enhancing the investment growth.

- Tax Benefits: Premiums qualify for deductions under Section 80C, and the maturity amount is tax-free under Section 10(10D).

How It Works: An Example

Consider the case of Anand, a father who wishes to secure his child’s future education.

- Annual Premium: ₹2.04 lakh

- Policy Term: 15 years

- Payout Period: 7 years

- Annual Income Benefit: ₹3.88 lakh

In the event of Anand’s demise, the company pays all future premiums, and the policy continues uninterrupted. Upon maturity, Anand’s child receives a guaranteed annual income of ₹3.88 lakh for 7 years, ensuring funds are available for higher education and other needs.

Why Choose SmartKid Assure?

- Comprehensive Coverage: Combines life insurance with investment growth, ensuring financial security for your child.

- Flexible Premium Options: Choose between regular pay or limited pay premium payment terms.

- Investment Flexibility: Switch between funds to align with changing market conditions.

- Emergency Access: Access funds in case of emergencies after the 5-year lock-in period.

- Structured Payouts: Opt for structured payouts over 5 years after maturity to manage funds effectively.ICICI Prudential Life Insurance

How the plan works?

Final Thoughts

ICICI Pru SmartKid Assure is more than just an insurance plan; it’s a financial tool that grows with your child’s needs. By investing in this plan, you ensure that your child’s educational aspirations and financial requirements are met, regardless of unforeseen circumstances. It’s a smart step towards securing a brighter future for your child.

For more details or to calculate your premium, visit the ICICI Pru SmartKid Assure page.

FAQ’s

What is a ULIP plan for a child’s future?

A ULIP (Unit Linked Insurance Plan) for a child combines investment and insurance to help parents build a financial corpus for their child’s education, marriage, or other future needs.

How does a child ULIP plan work?

You pay premiums that are partly invested in market-linked funds (like equity or debt) and partly used for life insurance coverage. It grows over time, offering a lump sum at maturity.

Why choose a ULIP for child’s education?

It provides both protection and wealth creation, plus it offers tax benefits and flexible fund-switching options to align with changing financial goals.

What are the benefits of child ULIP plans?

Key benefits include life cover for the parent, disciplined long-term savings, tax deductions under Section 80C, and potential for higher returns compared to traditional plans.

Which features should I look for in a child ULIP plan?

Look for low charges, good fund performance, premium waiver benefits, flexibility to switch funds, and a strong insurer track record.

Is investing in child ULIP plans safe?

While ULIPs involve market risks, they can be safer for long-term goals if you choose funds wisely (like balanced or debt funds) and stay invested for the full policy term.